What Affects Your Credit Score? The 5 Factors That Matter Most

Photo by Aleksandrs Karevs

If you’ve ever checked your credit score and wondered why it moved up, down, or didn’t budge at all, you’re not alone.

For most people, credit scores feel like a black box — something that quietly changes in the background while you’re just trying to pay bills, raise kids, and keep life moving.

The truth is, your credit score isn’t random. It’s shaped by a handful of very specific behaviors, many of which show up in everyday decisions: when you pay a bill, how much you carry on a credit card, or whether you open a new account at the wrong time.

Once you understand what actually affects your credit score, it becomes much easier to stop guessing and start making moves that work in your favor.

That matters more than most parents realize. A stronger credit score can mean lower interest rates on a car, better terms on a mortgage, cheaper insurance, and fewer financial headaches when something unexpected comes up.

And the good news is that improving your score usually has less to do with perfection and more to do with consistency.

In this article, we’ll walk through exactly what affects your credit score, how much each factor matters, and what those factors look like.

Along the way, we’ll call out common mistakes, clear up a few myths, and show you practical ways to protect and improve your score without turning your finances into a full-time job.

By the end, you’ll have a clear picture of what’s helping your credit, what might be holding it back, and which actions are worth focusing on right now.

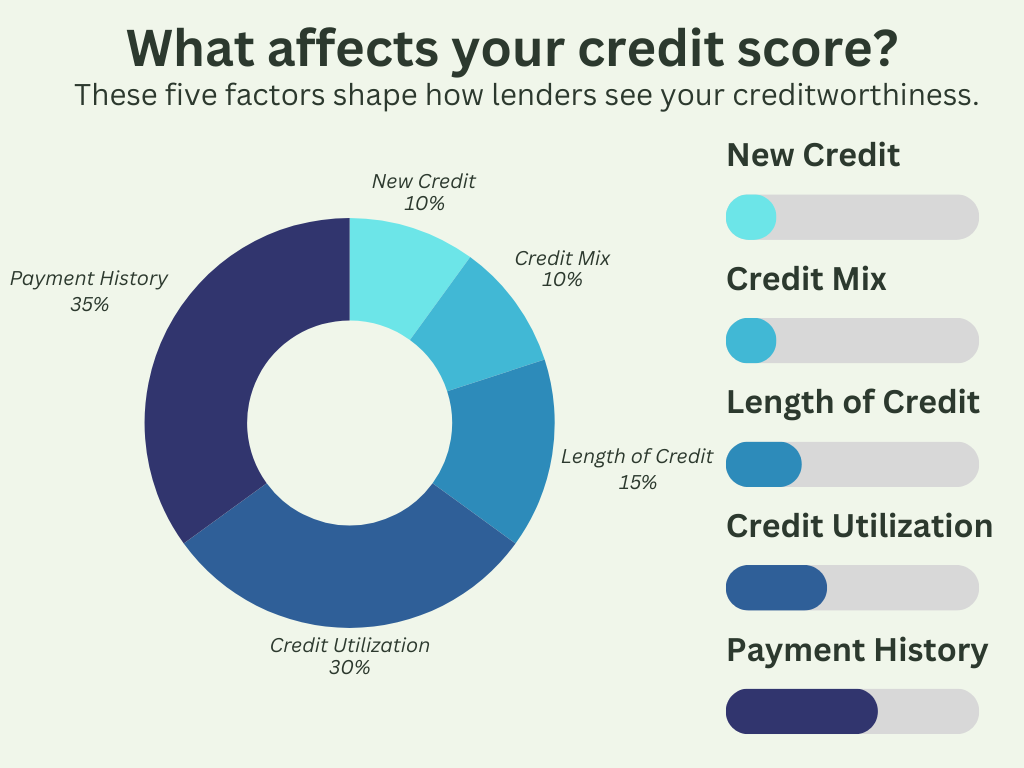

The 5 Main Factors That Affect Your Credit Score

When lenders calculate your credit score, they’re not judging your income, your job title, or how “good” you are with money overall.

They’re looking at a short list of behaviors pulled directly from your credit report. Each one plays a different role, and some matter far more than others.

If you look at the chart above, you’ll notice that two factors do most of the heavy lifting. The remaining three still matter, but they tend to fine-tune your score rather than drive big swings on their own.

Here’s how each one works in real life.

Payment History (35%)

Payment history carries the most weight because it answers a simple question: do you pay your bills on time?

Every time you make a payment on a credit card, auto loan, student loan, or mortgage, it’s recorded.

On-time payments help your score.

Late payments hurt it and the later they are, the more damage they tend to do.

A payment that’s 30 days late is a problem. One that’s 60 or 90 days late is a much bigger one.

What surprises many people is that perfection isn’t required. Missing one payment years ago doesn’t doom your credit forever.

What matters most is your pattern over time.

Consistently paying at least the minimum by the due date builds trust with lenders, even if you’re still working through balances or other financial goals.

For busy parents, this is one of the easiest areas to protect: automatic payments, calendar reminders, and simple systems go a long way here.

Credit Utilization (30%)

Credit utilization looks at how much of your available credit you’re using. It’s usually expressed as a percentage.

For example, if you have a credit card with a $10,000 limit and a $3,000 balance, your utilization on that card is 30%.

Lenders generally like to see lower utilization because it signals that you’re not stretched too thin.

This factor is one of the biggest reasons scores fluctuate month to month.

You can make every payment on time and still see your score dip temporarily if your balances creep up.

The flip side is encouraging: paying balances down often leads to quicker score improvements than people expect.

Utilization is calculated both per card and across all your cards combined, which means spreading balances out or paying one card down aggressively can sometimes help more than closing an account.

Length of Credit History (15%)

Length of credit history reflects how long you’ve been using credit.

This includes:

The age of your oldest account

The age of your newest account

The average age of all your accounts

This factor tends to reward patience.

Older, well-managed accounts help your score simply because they show a longer track record.

That’s why closing an old credit card (even one you don’t use much) can sometimes hurt more than people expect.

If you’re earlier in your credit journey, this section improves naturally over time.

There’s no shortcut here, but there’s also no need to overthink it. Keeping accounts open and in good standing does most of the work for you.

Credit Mix (10%)

Credit mix looks at the variety of credit accounts you have, such as credit cards, auto loans, student loans, or a mortgage.

This is a smaller factor, and it’s often misunderstood.

You don’t need to open new accounts just to “improve” your mix. Lenders simply want to see that you can manage different types of credit responsibly if and when they exist.

For most people, credit mix takes care of itself as life happens…a car purchase, a home, or an education expense.

It’s rarely worth chasing on its own.

New Credit (10%)

New credit considers how often you apply for and open new accounts.

Each hard inquiry and new account slightly increases perceived risk, especially if several happen close together.

This doesn’t mean you should avoid new credit forever. It just means timing matters.

Applying for multiple cards or loans in a short window can temporarily lower your score, even if everything else looks solid.

If you’re planning a major purchase like a car or home, being strategic about new applications in the months leading up to it can help keep your score steady.

Other Things That Can Affect Your Credit Score

Beyond the five main factors, there are a handful of situations that can influence your credit score in meaningful ways.

These don’t always show up in simple explanations, but they’re often the reason someone’s score changes unexpectedly.

Understanding these helps you avoid surprises and respond more confidently when something does show up on your credit report.

Collections and Charge-Offs

When an account goes unpaid for long enough, it may be sent to collections or charged off by the lender. This signals a serious breakdown in repayment and can have a noticeable impact on your credit score.

That said, not all collections are treated the same.

The size of the debt, how recent it is, and whether it’s been resolved all matter.

Older collections tend to hurt less over time, especially if your recent payment history is strong.

Paying or settling a collection doesn’t always remove it immediately, but it can help prevent further damage and may improve your score depending on the scoring model.

If something in collections surprises you, it’s worth reviewing the details closely. Errors do happen, and disputing inaccurate information is part of maintaining healthy credit.

Medical Debt

Medical debt is one of the most common credit issues for families, often tied to insurance delays or billing confusion rather than financial irresponsibility.

Recent changes have reduced the impact of medical collections on credit scores, especially for smaller balances or debts that have been paid.

While unpaid medical debt can still appear on your report, it generally carries less weight than other types of collections.

If medical bills are part of your credit picture, focusing on communication and payment plans can help limit long-term damage.

Bankruptcies, Foreclosures, and Repossessions

Major financial events like bankruptcies, foreclosures, or repossessions have a significant effect on credit scores because they represent severe financial distress.

These marks stay on your credit report for several years, but their impact fades over time.

What matters most after an event like this is what comes next. Rebuilding with consistent on-time payments, low balances, and fewer new accounts can gradually restore your credit standing.

Many people recover far more than they expect within a few years, especially when they focus on stability rather than speed.

Authorized User Accounts

Being added as an authorized user on someone else’s credit card can affect your credit score, for better or worse.

If the account has a long history of on-time payments and low balances, it can help strengthen your credit profile. If the primary cardholder carries high balances or misses payments, it can have the opposite effect.

This can be a useful tool in the right situation, but it works best when expectations and usage are clear.

Reporting Timing and Statement Balances

One of the more frustrating aspects of credit scoring is timing. Credit card companies usually report balances based on your statement date, not your payment date.

That means you can pay your card in full every month and still see a higher reported balance if your spending peaks before the statement closes.

This doesn’t mean you’re doing anything wrong — it just explains why scores sometimes move even when habits haven’t changed.

Being aware of statement dates can help if you’re preparing for a credit check or major application.

What Does Not Affect Your Credit Score

There’s a lot of advice floating around about credit, and not all of it is helpful.

Some of the most common worries people have simply don’t factor into credit scores at all. Clearing these up can save you time, stress, and unnecessary second-guessing.

Your Income or Job Title

How much money you make doesn’t appear on your credit report, and it isn’t used to calculate your credit score.

Neither does your job title, employer, or how long you’ve been employed.

Credit scores focus on how you manage borrowed money, not how much you earn.

Someone with a modest income and consistent habits can have a higher score than someone earning significantly more but managing credit less carefully.

Your Age, Gender, or Family Status

Personal characteristics like your age, marital status, whether you have kids, or where you’re from are not part of credit scoring.

This is intentional.

Credit scoring models are designed to evaluate financial behavior, not personal identity or life stage. Becoming a parent, getting married, or changing family dynamics won’t directly move your score up or down.

Checking Your Own Credit

Reviewing your own credit report or credit score does not hurt your credit.

These are considered soft inquiries and have no negative impact.

In fact, regularly checking your credit is one of the best ways to stay on top of errors, spot fraud early, and understand how your habits are showing up on your report.

Paying Bills That Don’t Use Credit

Everyday bills like rent, utilities, cell phone plans, streaming services, or daycare expenses usually don’t affect your credit score unless they go unpaid and are sent to collections.

Paying these on time is still important for your overall financial health, but they don’t automatically help your credit unless they’re tied to a credit account or reported through a specific program.

Closing an Account with No Balance

Closing a credit card with a zero balance doesn’t create a penalty by itself. The impact comes indirectly, often through changes in your available credit or the average age of your accounts.

This is why closing accounts is a decision worth thinking through rather than reacting to. Sometimes it makes sense. Sometimes it’s better to leave an unused account open.

Knowing what doesn’t matter is just as important as knowing what does. It helps you focus your energy where it actually counts.

Common Mistakes That Can Hurt Your Credit Score

Most credit score drops don’t come from big financial disasters.

They usually come from small, easy-to-miss decisions that add up over time. The good news is that once you know where these trouble spots are, they’re often straightforward to avoid.

Carrying High Balances for Too Long

Using a credit card occasionally isn’t a problem. Letting balances stay high month after month is.

Even if you’re making every payment on time, high balances can signal financial strain and push your score down.

This is especially true when balances creep above a large portion of your available credit.

Focusing on paying down one card at a time or timing payments around statement dates can help bring utilization back into a healthier range without requiring drastic changes.

Missing Payments by Accident

Many late payments aren’t intentional. They happen because life gets busy and due dates get lost in the shuffle.

Once a payment is 30 days late, it can show up on your credit report and stay there for years.

Simple safeguards like autopay for minimums or calendar reminders can prevent a lot of unnecessary damage.

This is one of the highest-impact areas where systems matter more than willpower.

Opening Several Accounts at Once

Applying for multiple credit cards or loans in a short period can raise red flags.

Each application creates a hard inquiry, and opening several new accounts lowers the average age of your credit.

Spacing applications out and being intentional about when you apply can help protect your score, especially if you’re planning a major purchase in the near future.

Ignoring Your Credit Report

Not checking your credit report makes it harder to catch errors, fraud, or outdated information.

These issues can quietly drag down your score without you realizing it.

A quick review a few times a year can alert you to problems early, when they’re easier to address.

A Simple 30-60-90 Day Plan to Improve Your Credit Score

Improving your credit score doesn’t require a complete financial overhaul.

Small, focused actions done consistently tend to create the biggest gains.

This plan is designed to help you build momentum without adding stress or complexity.

You don’t have to do everything at once. Start where you are and move forward step by step.

Days 1–30: Stabilize and Protect What You Have

The first month is about preventing unnecessary damage and making sure your foundation is solid.

Start by checking your credit reports with all three bureaus.

Look for anything that doesn’t belong to you, looks outdated, or feels off. Even small errors can affect your score more than they should.

Next, lock in your payment systems.

If you haven’t already, set up autopay for at least the minimum payment on every credit account. This one move alone protects the most important factor in your credit score: payment history.

Finally, take inventory of your balances. You don’t need to pay everything down immediately.

Just understand where your utilization stands so you know which accounts deserve attention first.

Days 31–60: Lower Balances and Reduce Friction

Once payments are running smoothly, shift your focus to credit utilization.

Choose one or two accounts with higher balances and start paying them down intentionally.

Even modest reductions can help, especially if they bring your utilization below key thresholds.

If timing matters (for example, you’re planning to apply for a loan) pay attention to statement dates. Making a payment before the statement closes can reduce the balance that gets reported, which may help your score sooner.

This is also a good time to pause unnecessary credit applications.

Let your accounts age and your recent activity settle.

Days 61–90: Strengthen and Optimize

By the third month, you’re building consistency. Now it’s about reinforcing what’s working.

Review your progress and check your score again. Small improvements are meaningful here. Credit scores often move gradually, and that’s normal.

If you have older accounts in good standing, keep them open and active with occasional small charges. This supports both utilization and length of credit history.

You can also reassess authorized user accounts or lingering collections at this stage.

With a clearer picture of your credit profile, decisions tend to feel more confident and less reactive.

Final Thoughts

Credit scores tend to feel more complicated than they actually are.

When you zoom out, they’re built on a small set of behaviors that show up in everyday life: paying bills on time, keeping balances manageable, and being thoughtful about new credit.

Understanding what affects your credit score gives you back a sense of control.

Instead of guessing why your score changed or worrying about things that don’t matter, you can focus on the actions that truly move the needle.

For most families, that means building a few simple systems and letting time do its job.

If your score isn’t where you want it to be right now, that’s okay. With steady habits and a little patience, it can improve.

And if your score is already in good shape, knowing what affects it helps you protect it as life gets busier and financial decisions get bigger.

Small, consistent steps count. You don’t have to do everything at once, just keep moving in the right direction.

Frequently Asked Questions About What Affects Your Credit Score

-

Payment history has the biggest impact on your credit score.

Making on-time payments consistently matters more than any other factor.

Credit utilization (how much of your available credit you’re using) is the next most important.

-

Your credit score can change within a single billing cycle.

Paying down a high balance, missing a payment, or opening a new account can all affect your score within weeks, depending on when lenders report activity.

-

Paying down or paying off a credit card often helps your credit score by lowering your credit utilization.

The biggest improvements usually happen when balances drop below key thresholds, especially if they were previously high.

-

No. You do not need to carry a balance to build or maintain good credit.

Paying your statement balance in full each month still counts as positive payment history and avoids unnecessary interest.

-

There’s no ideal number of credit cards. What matters is how you manage the accounts you have.

A small number of well-managed cards can support a strong credit score just as effectively as several accounts.

-

Late payments can remain on your credit report for up to seven years, but their impact fades over time.

Recent payment behavior carries more weight than older mistakes, especially when positive habits are established afterward.

-

No. Checking your own credit score or credit report is considered a soft inquiry and does not affect your credit score.

Regularly reviewing your credit is a healthy habit.

-

Closing a credit card can affect your score indirectly by reducing available credit or shortening your credit history.

Whether it hurts depends on your overall credit profile and which account you close.

-

Rent payments usually don’t affect your credit score unless they’re reported through a rent-reporting service or sent to collections.

Paying rent on time is still important, but it doesn’t automatically build credit.

-

One missed payment won’t ruin your credit forever, but it can cause a noticeable drop, especially if your credit history is otherwise limited.

The impact lessens over time as you return to consistent on-time payments.