The financial ramblings of a parent.

Recent Posts

Should I Pay Off Debt or Save First? How to Decide Based on Your Situation

Trying to decide whether to pay off debt or save first? Learn how interest rates, emergency savings, and long-term goals shape the right choice for your situation.

How to Use Credit Responsibly: Practical Habits That Actually Work

Learn how to use credit responsibly with simple, real-life habits. Avoid common mistakes, manage balances, and build healthier credit over time.

How Long Does It Take to Rebuild Credit? A Realistic Timeline

Rebuilding credit takes time, but progress can happen sooner than you think. Learn how long it usually takes and what to expect at each stage.

7 Smart Money-Saving Tips for Families in 2026 (That Actually Work)

Discover 7 practical money-saving tips for families in 2026, from cutting everyday expenses to building smarter habits that help you save more and stress less.

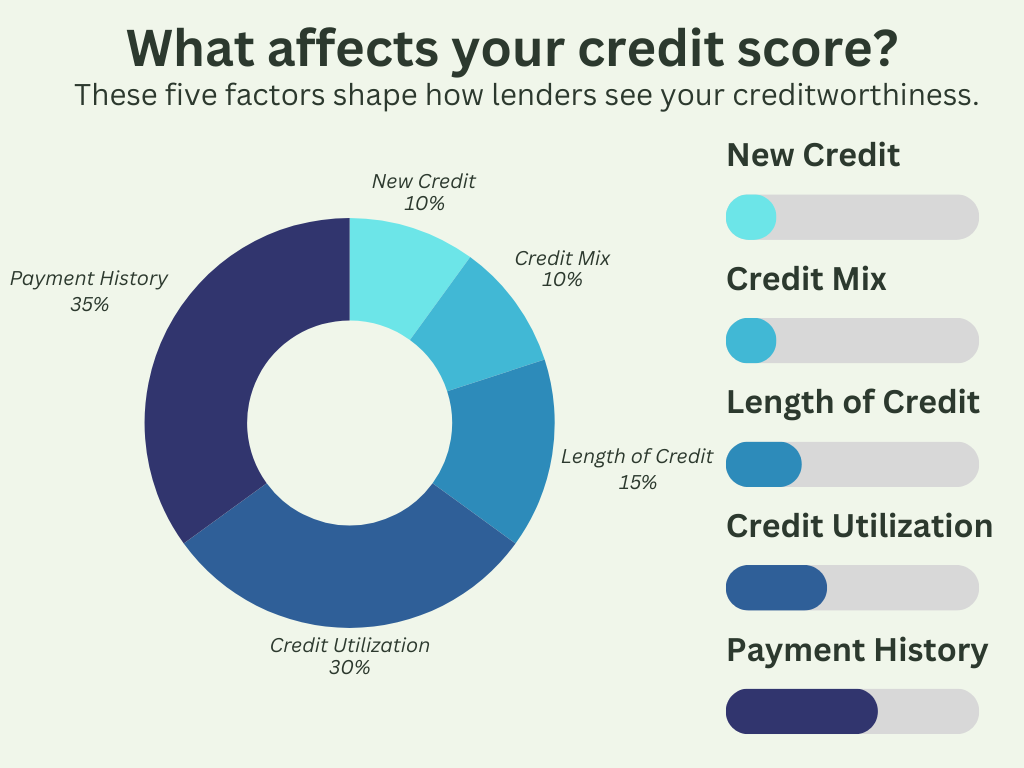

What Affects Your Credit Score? The 5 Factors That Matter Most

Wondering what affects your credit score?

Learn the 5 key factors, common mistakes, and simple steps you can take to improve it over time.

11 Smart Ways to Save on Holiday Travel in 2026: Expert Tips for Families

Discover 11 actionable tips to save on holiday travel in 2026. Learn the best booking times, packing tricks, mileage hacks, and more. Make your holiday trip affordable and stress-free with these smart travel tips for families.

How to Get Free Land in the US (2026 Guide for Families)

Discover how to get free land in the US in 2026. Learn which towns still offer land for free, what it really costs, and how families can make it work.

Emergency Fund vs Debt Payoff: What to Focus on First (A Practical Guide for Families)

Trying to decide between building an emergency fund or paying off debt first?

Learn how to prioritize emergency savings and debt payoff based on income, expenses, and real family life.

How Much Emergency Fund Should I Have? A Practical Guide for Families

How much emergency fund should you have? Learn how to calculate the right amount for your family based on income, expenses, and risk, and how to build it step by step.

Debt Snowball vs Avalanche: Which Debt Payoff Method Is Better for Families?

Debt snowball vs avalanche explained in plain English.

Learn the differences, see real payoff examples, and choose the debt strategy that actually fits your life and budget.

How Much Can You Make Without Filing Taxes? Income Limits Explained

How much can you make without filing taxes? Learn the income limits, how W-2 and side hustle income differ, and when filing is still required.

How to Save Money as a Couple: 6 Proven Tips for Parents

Discover how to save money as a couple with 6 practical tips. Learn to budget, set goals, cut costs, and build wealth together without stress.

70/20/10 Budget Explained: The Simple Financial Plan Every Parent Needs

Simplify your finances with the 70/20/10 budget. Learn to allocate 70% for needs, 20% for savings, and 10% for debt or giving. This guide is packed with tips tailored to busy parents ready to take control of their money.

Why Use Credit Cards (and What to Use Them For): A Practical Guide for Parents in 2025

Wondering what to use credit cards for—and why they’re worth using at all? Learn how to use credit cards smartly in 2025 to earn rewards, protect your money, and keep your family’s budget on track.

How to Upgrade Your Wardrobe on a Budget: Smart Style Tips for Parents

Refresh your wardrobe without overspending. This guide for parents shares practical tips, budget-friendly brands, and smart capsule wardrobe ideas.

How to Save for a Downpayment (Without Losing Your Mind as a Parent)

Saving for a downpayment doesn’t have to feel impossible — even with daycare bills and toy explosions.

This parent-friendly guide breaks down how to save smart, earn more, and hit your homeownership goals without losing your mind.

Unclaimed Baggage Could Save You Big: Shop for Treasures at America's Hidden Gem

Ever wondered what happens to lost luggage? Discover the fascinating journey of unclaimed baggage, explore the iconic Unclaimed Baggage store in Alabama, and learn how to score unique finds at up to 80% off retail prices.

3 Simple Ways to Save Money and Live Better in 2025

Discover 3 simple yet powerful ways to save money and improve your quality of life in 2025. These actionable tips will help you cut costs, reduce stress, and live better on a budget

Zero-Based Budgeting Made Simple: A Practical Guide for Busy Parents

Simplify your finances with zero-based budgeting! This practical guide for busy parents breaks down actionable steps to assign every dollar a job and achieve financial clarity.

The Savings-First Budget: How Parents Can Build Wealth Faster

Pay yourself first! Discover the Savings-First Budget method and learn how to prioritize saving while managing your family's finances. Perfect for parents looking to grow wealth and secure their financial future.