Should I Pay Off Debt or Save First? How to Decide Based on Your Situation

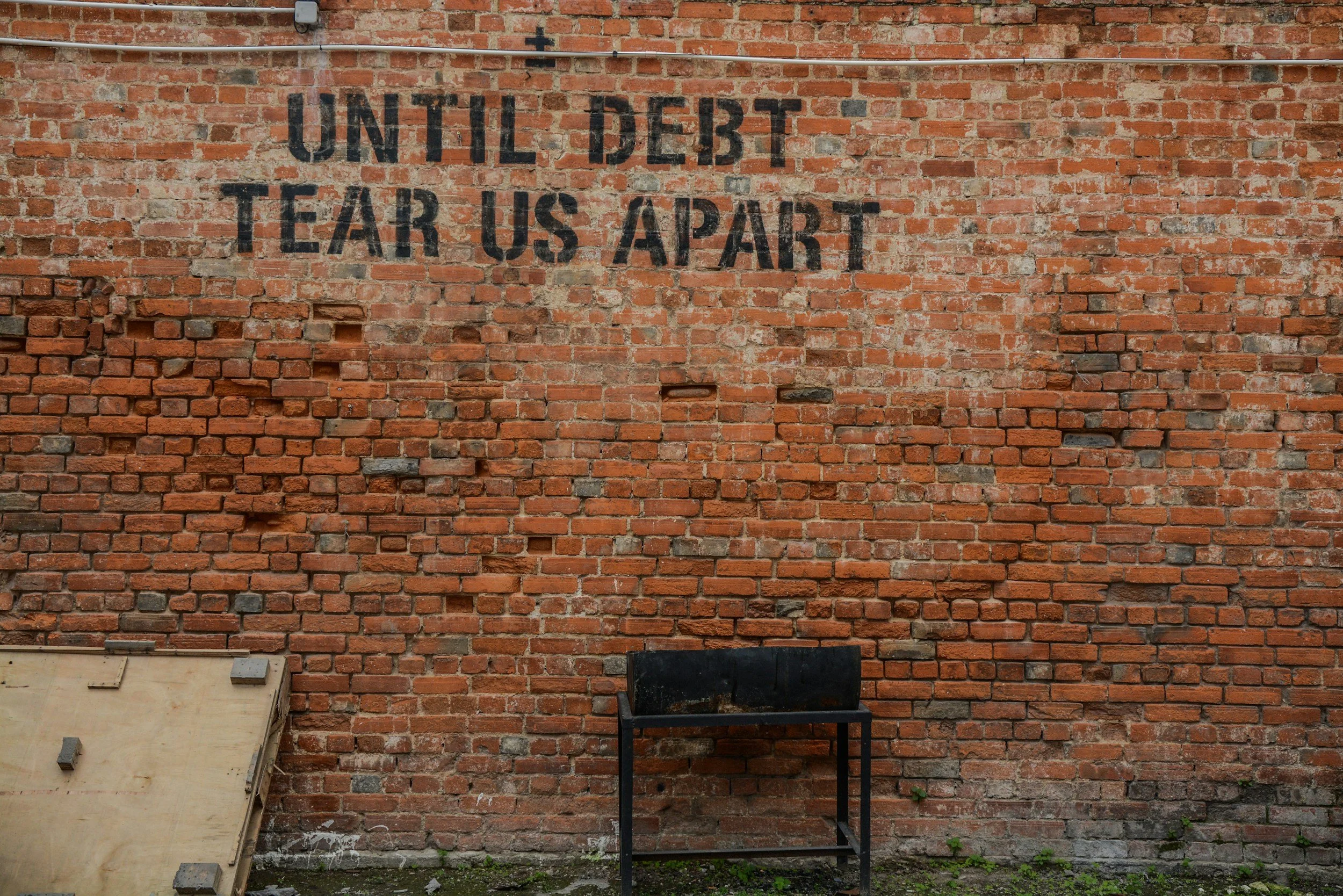

Image by Alice Pasqual

Should I Pay Off Debt or Save?

If you’ve ever stared at your bank account wondering whether your extra money should go toward debt or savings, you’re not alone.

This is one of the most common money questions parents ask — especially once life starts getting expensive in new and creative ways.

Diapers turn into daycare. Daycare turns into sports fees. And somehow, at the same time, credit card balances, student loans, and car payments are still hanging around. So when a little extra cash shows up, the pressure is real: Should I pay off debt or save?

Most advice online gives you a confident answer very quickly. But real life doesn’t work that cleanly — especially for parents balancing income, kids, careers, and long-term goals all at once.

Below, I’ll cover a few aspects on how to decide whether paying off debt or saving makes sense for your situation. We’ll look at the math, the real-world tradeoffs, and the decisions that tend to trip people up.

If it helps to go a layer deeper on a few of the big building blocks behind this decision, these additional articles can help:

Why This Decision Isn’t Simple

On paper, this decision feels like it should be straightforward.

Debt has interest.

Savings earns interest.

Compare the numbers and move on.

In real life, money decisions rarely happen on paper.

Parents are balancing competing priorities at the same time. You might be trying to get ahead financially while also needing flexibility for unexpected expenses. You might be carrying debt that feels emotionally heavy, even if the interest rate isn’t catastrophic.

You might technically be able to save, but doing so leaves you feeling exposed if something goes wrong.

This is where a lot of people get stuck.

Paying off debt can feel productive and relieving, but it can also leave you vulnerable if your savings are thin. Saving money can create a sense of security, but it can feel discouraging when balances grow slowly while debt interest keeps ticking up in the background.

The tension comes from the fact that debt and savings solve different problems.

Debt payoff improves your long-term financial position by lowering obligations and freeing up future cash flow. Savings protects your short-term stability by giving you options when life happens.

Ignoring either side usually creates stress somewhere else.

That’s why blanket advice falls apart so quickly. A single rule can’t account for differences in income stability, family size, interest rates, or how close you are to needing that money.

Before deciding where your next dollar should go, it helps to understand the two forces driving this decision:

The math behind interest and returns

The role savings plays in preventing future debt

We’ll start with the math, because it gives us a clear baseline to work from.

The Financial Math That Actually Matters

Once emotions and uncertainty are stripped away, this decision starts with a simple comparison: what your money costs you versus what it earns for you.

Debt works against you through interest. Savings works for you through interest or returns. The gap between those two numbers is where clarity starts to form.

To make this tangible, here’s what that looks like in real life.

A Simple Interest Comparison

When looking at some of the most common financial tools on the market, you can easily see the swing in interest rates.

Credit card: 18%–25% APR

Personal loan: 8%–12% APR

Student loan (federal): 4%–7% APR

Auto loan: 3%–6% APR

High-yield savings account: 3%–5% APY

Now imagine you have an extra $1,000.

If that $1,000 sits in a high-yield savings account earning 4.5%, it generates about $45 in interest over a year.

If that same $1,000 pays down a credit card charging 22%, it avoids roughly $220 in interest over that same year.

That difference adds up quickly, especially when balances roll month after month.

This is why high-interest debt tends to demand attention. The math is working against you in a very visible way.

Lower-interest debt behaves differently. Paying down a 4% student loan saves about $40 per year per $1,000.

At that point, the numbers start to look similar to what savings can earn — and that’s where context matters more.

Why Interest Rates Matter More Than Balances

A smaller balance with a high interest rate can be more harmful than a larger balance with a low one.

Two examples:

A $3,000 credit card balance at 22% costs about $660 per year in interest.

A $15,000 car loan at 4% costs about $600 per year in interest.

Even though the car loan is five times larger, the credit card quietly does more damage.

This is why looking only at balances can lead you in the wrong direction. Rates tell you how urgently your money needs to work.

Where Math Stops Being the Whole Story

Even when the numbers point clearly toward debt, savings still plays a critical role.

Savings doesn’t just earn interest. It prevents future debt.

Without a cash buffer, one unexpected expense can erase months of progress and send balances right back up. That’s why the next part of the decision focuses less on returns and more on stability.

The Emergency Fund Comes Into Play

The numbers help clarify urgency, but they don’t eliminate risk.

Even when paying off debt clearly “wins” on paper, savings still plays a critical role. An emergency fund isn’t about earning interest or optimizing returns. It’s about preventing progress from being undone.

Without some cash set aside, unexpected expenses tend to land in the worst possible place — back on a credit card or loan you were just starting to get under control. That cycle is frustrating, and it’s one of the main reasons people feel like they’re spinning their wheels financially.

This is where an emergency fund changes the equation.

Having accessible cash gives you room to breathe. It absorbs the car repair, the medical bill, or the last-minute travel without forcing you to choose between new debt and derailing your plan.

For most households, this doesn’t require a massive savings goal right away. A starter emergency fund is often enough to reduce stress and protect against common surprises while you continue making progress elsewhere.

Once that baseline is in place, the decision becomes far less reactive. Instead of asking where every dollar should go in a crisis, you can be intentional about how to split money between savings and debt over time.

When Paying Off Debt First Makes Sense

Paying off debt tends to rise to the top when interest rates are working aggressively against you. In these situations, every dollar sent toward debt immediately reduces a guaranteed cost.

High-interest debt is the clearest example. Credit cards, some personal loans, and other revolving balances can quietly undo progress elsewhere by compounding month after month. Reducing or eliminating these balances often frees up cash flow faster than saving alone.

Debt payoff also makes sense when your savings already cover short-term needs. If you have enough cash on hand to handle common surprises, additional dollars are usually more effective when they go toward lowering obligations rather than sitting idle.

There’s also a behavioral component worth acknowledging. Carrying debt can feel heavy, even when the numbers are manageable. For some people, seeing balances shrink creates momentum and confidence that spills into other financial decisions. That psychological relief has real value when it leads to consistency.

Paying off debt first tends to work well when:

Interest rates are meaningfully higher than what savings can earn

Minimum payments are eating into monthly flexibility

You already have some cash set aside for emergencies

This approach is simply about removing the most expensive friction in your financial system so future progress becomes easier to sustain.

When Saving Comes First

Saving tends to take priority when stability is the bigger concern. This usually shows up when cash is tight, income is uneven, or there’s little room for error if something unexpected happens.

If your savings are close to zero, even small disruptions can create outsized stress.

A flat tire, a medical copay, or a missed paycheck can push expenses straight back onto a credit card, often at a higher interest rate than before. In that scenario, saving first helps stop the cycle from repeating.

Saving also makes sense when your debt carries relatively low interest. Loans in the 3–6% range behave very differently than high-interest credit cards. When rates are closer to what savings can earn, the urgency shifts from speed to flexibility. Cash on hand gives you options without significantly worsening the math.

Upcoming known expenses matter here too. If you know a large bill is coming (ex. a move, home repair, or childcare change) directing money toward savings can prevent those costs from becoming new debt.

Planning ahead often costs less than reacting later.

Saving first is often the right move when:

You don’t have enough cash to handle common emergencies

Your income varies or feels unpredictable

Your debt interest rates are relatively low

A large expense is on the horizon

This approach isn’t about ignoring debt. It’s about building enough financial cushion so that progress sticks.

Once savings provides a buffer, debt repayment becomes steadier and less stressful.

A Balanced Approach for Many Families

For a lot of households, the answer doesn’t land cleanly on one side.

There’s debt that needs attention and savings that can’t be ignored. In those cases, splitting your focus can create steady progress without increasing stress.

A balanced approach usually starts with setting a minimum savings target. Once there’s enough cash on hand to handle common surprises, extra money can be divided between savings and debt repayment. This keeps momentum moving in both directions.

This method works well for families with stable income and moderate debt. You’re reducing interest costs over time while also increasing flexibility. Progress may feel slower in any one category, but the overall system becomes more resilient.

Consistency matters more than precision here.

Small, regular contributions compound — both in reduced debt and increased savings. Automating transfers and extra payments helps remove decision fatigue and keeps the plan running in the background.

A balanced approach often fits when:

You have some emergency savings, but not a full cushion yet

Your debt spans multiple interest rates

You want progress without feeling financially exposed

The goal is to create a system that holds up under pressure.

When savings and debt reduction move together, it’s easier to stay the course even when life gets noisy.

Choosing a Debt Repayment Strategy That You’ll Stick With

Once you’ve decided that debt repayment deserves some focus, the next question is how to approach it. The best strategy is the one you can follow consistently, because steady progress beats theoretical optimization every time.

Two common structures show up most often.

One approach focuses on interest rates. Extra money is directed toward the balance with the highest rate while minimum payments continue on everything else. This reduces the total amount of interest paid over time and usually shortens the payoff timeline.

The other approach focuses on balance size. Extra money goes toward the smallest balance first, with minimum payments maintained on the rest. As each balance is paid off, that payment rolls into the next one, increasing momentum.

Here’s what that looks like in practice:

Assume you have $500 per month available for debt payments and three balances:

Credit card A: $2,500 at 22% interest (minimum $75)

Credit card B: $4,000 at 18% interest (minimum $120)

Auto loan: $12,000 at 4% interest (minimum $260)

Your minimum payments total $455, leaving $45 in extra cash each month.

Rate-focused approach

That $45 goes toward Credit Card A because it carries the highest interest rate. As that balance falls, more of each payment goes toward principal instead of interest.

Once it’s paid off, the full $120+ minimum from Card B rolls into the next target.

Balance-focused approach

If Credit Card A is the smallest balance, the $45 still goes there first. But if Card B were smaller, you might start there instead to create a quicker win and simplify your accounts faster.

In both cases, the mechanics are similar. Minimums stay the same. Extra dollars stay focused. The difference is where you aim first.

How to Choose Between Them

If your interest rates vary widely and high-interest balances are large, rate-focused repayment often saves money over time.

If your balances are smaller or motivation has been an issue in the past, balance-focused repayment can create faster psychological wins.

It can also help to consider cash flow. Paying off a smaller loan may free up a meaningful monthly payment sooner, even if it isn’t mathematically perfect. That flexibility can make future decisions easier.

Whichever path you choose, clarity is the key.

Write down:

The order you’ll pay debts

The amount going to each one

What happens when a balance disappears

When the plan is clear, you remove the temptation to shuffle money around each month.

Debt repayment becomes much less overwhelming when it’s treated as a repeatable system rather than a series of emotional choices. Once the structure is in place, progress tends to follow naturally.

How Long-Term Goals Fit Into This Decision

Debt and savings usually get the spotlight because they feel immediate. Long-term goals tend to sit quietly in the background, even though they’re doing important work over time.

This is where people often feel torn.

Putting money toward retirement or future goals can feel abstract when there’s debt on the table or when savings still feel fragile. At the same time, pushing long-term goals off entirely can create pressure later that’s harder to unwind.

The key is understanding how these goals interact.

The Role of Retirement Contributions

For many working parents, retirement savings already exist in some form through an employer plan. Contributions may feel small or automatic, but they matter because of time and compounding.

As an example, contributing $250 per month starting in your early 30s can grow into several hundred thousand dollars over a few decades, even with moderate returns. Waiting ten years to start often means needing to contribute significantly more each month to reach the same outcome.

That doesn’t mean retirement should dominate every decision. It does mean that completely sidelining it for long stretches has consequences that aren’t obvious in the moment.

Balancing Present Pressure With Future Flexibility

Debt payoff and savings often improve your future options faster than retirement contributions alone.

Lower debt reduces fixed expenses. Savings creates breathing room. Both make it easier to increase long-term investing later.

This is why many families land on a layered approach:

Maintain consistent retirement contributions at a sustainable level

Build enough savings to handle short-term disruptions

Direct extra cash toward the most expensive debt

This structure allows progress on all fronts without overloading any single month.

Avoiding Common Tradeoffs That Backfire

A few patterns tend to create trouble over time:

Pausing retirement contributions indefinitely while focusing only on debt

Aggressively paying off debt without keeping any liquidity

Saving aggressively while allowing high-interest balances to linger

Each of these choices solves one problem while quietly creating another.

A steadier approach keeps the system balanced. Debt reduction lowers stress and future obligations. Savings absorbs surprises. Long-term investing keeps time working in your favor.

The exact mix will change as income grows, expenses shift, and debt disappears. Financial plans that adapt tend to last longer than rigid ones.

Bringing It All Together

Deciding whether to pay off debt or save is less about finding a perfect answer and more about choosing a direction that holds up in real life.

The right choice depends on a few key factors: how expensive your debt is, how much flexibility you have, and how exposed you’d be if something unexpected happened.

Those inputs change over time, and it’s normal for your priorities to shift as life does.

What matters most is having a plan you can stick with. When your money has a clear job (whether that’s reducing high-interest debt, building a cash buffer, or supporting long-term goals) progress feels steadier and less stressful.

Small, consistent decisions tend to outperform dramatic ones. Each dollar you direct intentionally strengthens your financial footing, even if the results don’t show up overnight.

If you ever feel unsure about the next move, that’s usually a sign to pause and reassess rather than push harder in one direction.

Clarity comes from understanding your numbers and adjusting as needed, not from following rigid rules.

This decision doesn’t need to be permanent. It just needs to work for where you are right now.

Frequently Asked Questions

-

It depends on two things: how expensive your debt is and how much flexibility you have.

High-interest debt tends to deserve attention sooner, while savings matters more when you don’t have cash available for surprises.

Many families benefit from doing some of both once a basic cushion is in place.

-

Using savings to pay off debt can make sense in limited situations, especially if the debt carries a very high interest rate and you still have enough cash left to handle emergencies.

Draining savings entirely often increases the risk of needing to borrow again later, which can undo progress.

-

A small starter emergency fund is usually enough to reduce risk while you work on debt.

This often means having enough to cover common, short-term expenses rather than aiming for a full multi-month cushion right away.

Once that baseline exists, debt repayment becomes easier to maintain.

-

Yes. When debt interest rates are relatively low and savings earns a comparable return, saving can provide flexibility without significantly worsening the math.

This is especially true when income is variable or a known expense is approaching.

-

Pausing retirement contributions for short periods may be reasonable in some cases, but doing so for long stretches can create pressure later.

Time plays a large role in long-term growth, and maintaining consistent contributions at a sustainable level often works better than stopping entirely.

-

Both approaches can work. Focusing on the highest interest rate tends to reduce total interest paid over time.

Focusing on smaller balances can create faster wins and simplify finances sooner. The better choice is the one that keeps you consistent.

-

Feeling stuck usually means too many decisions are happening at once.

Clarifying your interest rates, setting a minimum savings target, and choosing a single debt repayment order can remove most of the friction.

Progress becomes easier once the plan is simple.